Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About your Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About your Instructors

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

alternative-investments

08 Nov 2021

Methods of investing in alternative investments include:

- Fund investing.

- Co-investing.

- Direct investing.

Fund Investing

Fund investing is when investors contribute capital to a fund, and then the fund identifies, chooses, and makes investments on behalf of the investors. Investors pay a fee based on the value of the fund managers’ assets and performance fee if the fund manager delivers a return above the benchmark.

Fund investing can be termed as indirect investing in alternative assets. This is because fund investors’ investment decisions are based on whether to invest in the fund or not. Furthermore, investors do not influence the fund’s investments.

Fund investing applies to all types of alternative investments.

Advantages of Fund Investing

- Professional services, such as due diligence, offered by fund managers.

- Fund investing requires less investor involvement compared to direct and co-investing methods.

- Alternative investment option is accessible to anyone, regardless of their expertise.

- Diversification benefits come from the multiple investments found in a single fund.

Disadvantages of Fund Investing

- It is costly since the investor must pay management and performance fees.

- The investor is still expected to conduct due diligence when selecting the appropriate fund.

- Selecting the right fund is not easy due to asymmetry of information.

Co-investing

In co-investing, an investor indirectly invests in assets through the fund but also owns the rights (co-investment rights) to invest in the same assets directly. Intuitively, co-investing allows an investor to make parallel investments when the funds identify lucrative deals.

Advantages of Co-Investing

- The investor can learn from the fund’s expertise and improve at direct investing.

- Less due diligence is required.

- Investors co-invest an additional amount into that same investment, often without paying management fees on the capital they used for the direct investment.

- Compared to fund investing, co-investing allows investors to be more actively involved in managing their portfolios.

Disadvantages of Co-Investing

- Co-investors have reduced control over the investment selection process compared to direct investing.

- It may be subject to adverse selection bias. The fund may avail less attractive investment opportunities to the co-investor while allocating its own capital to more appealing deals.

- Co-investing requires an investor to be more actively involved in the investment since they must evaluate both investment opportunities and the fund manager.

- Co-investors have a limited amount of time to decide to either invest or not.

- Co-investing can be challenging for smaller firms with limited resources and due diligence experience.

Direct Investing

In direct investing, the investor directly invests in an asset without using any intermediary. Direct investing, therefore, gives investors higher control and flexibility when selecting their investments, financing methods, and approaches. However, investing directly in alternative investments is most popular among established investors in private equity and real estate. Pension funds and sovereign wealth funds may also invest in infrastructure and natural resources.

Advantages of Direct Investing

- The investor avoids paying ongoing management fees to an external manager.

- Direct investing allows the investor to create a portfolio of investments that suits their requirements.

- Direct investing provides the investor with the utmost flexibility and control over their investment.

Disadvantages of Direct Investing

- Direct investing requires a greater level of investment expertise.

- A direct investor won’t enjoy the diversification benefits of fund investing.

- Direct investing requires greater levels of due diligence because of the absence of a fund manager.

- Compared to fund investing, it requires a higher minimum capital.

Due Diligence

Due Diligence for Fund Investing

In fund investing, the choice of the fund manager influences portfolio performance. A good manager should have a verifiable performance record and adequate experience and expertise.

Due diligence should be conducted so that the targeted investment meets its risk and return expectations, investment approaches, and identify its limitations. Moreover, the investor should ensure that the fund has performed as expected and is still following its prospectus.

Due diligence on the fund involves the following:

Organization

- Experience and competence of the management team as well as compensation and staffing.

- Analysis of prior and current funds.

- Track record and alignment of interests.

- Reputation and quality of third-party service providers such as auditors and brokers.

Portfolio Management

- Investment procedure.

- Target markets, the types of and investment strategies.

- Sources of investments.

- Responsibilities of operating partners.

- Underwriting issues.

- Environmental and engineering review procedures.

- Integration of asset management or acquisitions or dispositions.

- Disposition process, including its initiation and execution.

Operations and Controls

- Reporting and accounting methods.

- Audited financial statements and other internal controls.

- Frequency and approach(es) of valuation.

- Insurance and contingency plans.

Risk Management

- Fund policies and limits.

- Risk management policy.

- Portfolio risk and key risk factors.

- Leverage and currency: risks or constraints or hedging.

Legal Review

- Fund structure.

- Registration’s record.

- Existing and prior litigation record.

Fund Terms

- Fees (management and performance) and expenses.

- Contractual terms.

- Investment period and fund term and extensions.

- Carried interest.

- Distributions.

- Conflicts.

- Limited partners’ rights.

- “Key-person” and/or other termination procedures.

Due Diligence for Direct Investing

In the case of direct investing, due diligence entails thorough research of the investor’s target business. The research, particularly, focuses on such factors as the quality of the management team, customers, competition, revenue avenues, and risk profile. For instance, in private debt investing, due diligence involves credit analysis of borrowers and assessment of their ability to service the debt payments for debt investing. Similarly, in real estate investment, due diligence involves assessment of the occupancy rate, and the tenant’s quality. Besides, buildings’ structure should be investigated.

Due Diligence for Co-Investing

Due diligence for direct investing applies to co-investing. In co-investing, investors rely majorly on the due diligence performed by the fund manager. Moreover, the independence of the due diligence may differ between direct investing and co-investing due to differences in how investment opportunities are sourced. For example, direct investing investment opportunities are usually outsourced by the direct investment team. On the other hand, in the case of co-investing, a fund manager outsources investments for investors’ consideration.

Question

Which of the following is most likely a disadvantage of co-investing?

- It may be subject to adverse selection bias.

- Selecting the right fund is not easy because of the asymmetry of information.

- The investor won’t enjoy the diversification benefits of fund investing.

Solution

The correct answer is A.

Co-investing may be subject to adverse selection bias. This is due to the fact that the fund makes less attractive investment opportunities available to the co-investor while allocating its own capital to more appealing deals.

B is incorrect. Selecting the right fund is not easy because of the asymmetry of information is a disadvantage of fund investing.

C is incorrect. Being unable to enjoy the diversification benefits is a disadvantage of direct investing and not co-investing.

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Learn with Us

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduate Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

Sergio Torrico

2021-07-23

Excelente para el FRM 2Escribo esta revisión en español para los hispanohablantes, soy de Bolivia, y utilicé AnalystPrep para dudas y consultas sobre mi preparación para el FRM nivel 2 (lo tomé una sola vez y aprobé muy bien), siempre tuve un soporte claro, directo y rápido, el material sale rápido cuando hay cambios en el temario de GARP, y los ejercicios y exámenes son muy útiles para practicar.

diana

2021-07-17

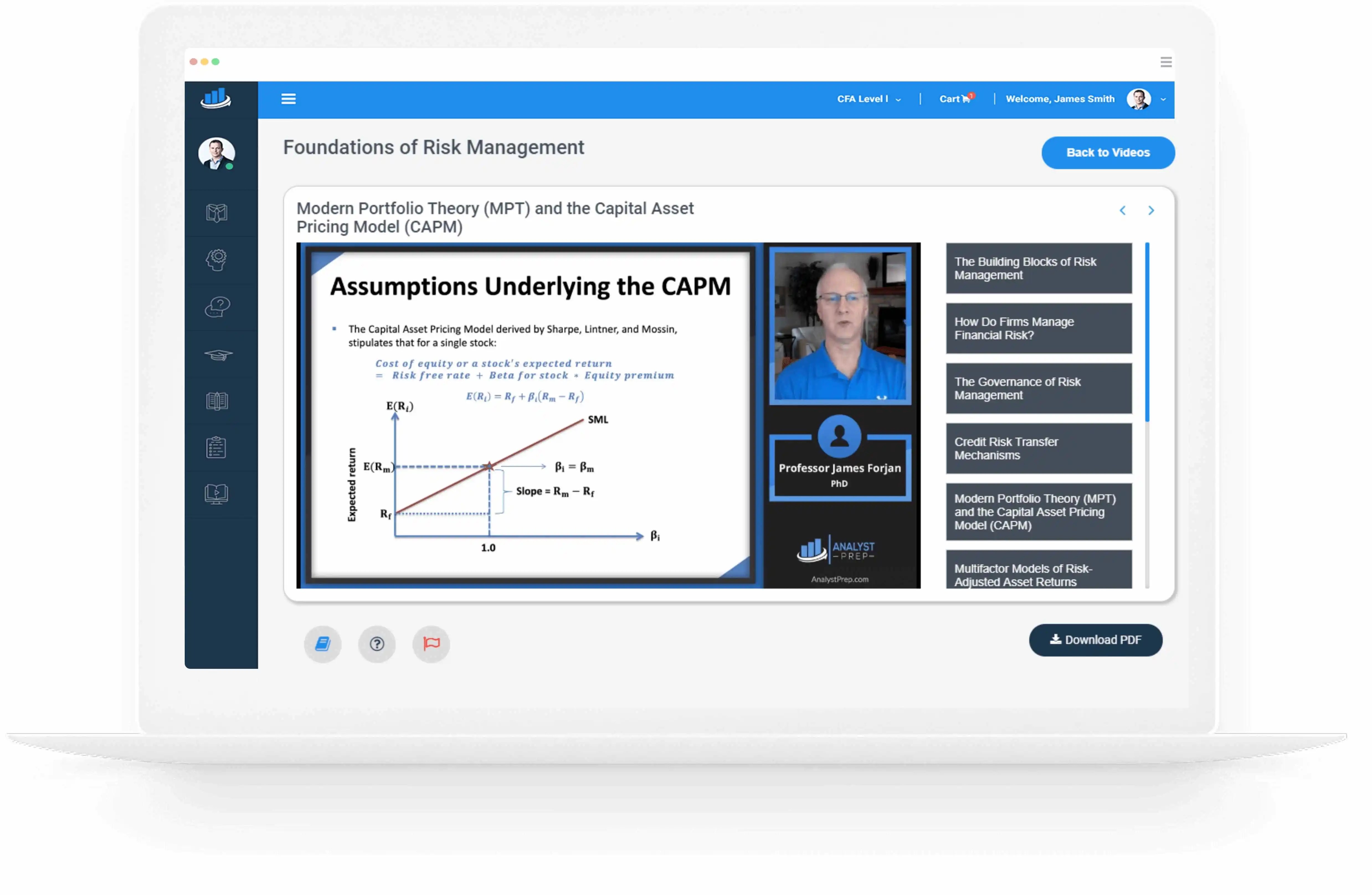

So helpful. I have been using the videos to prepare for the CFA Level II exam. The videos signpost the reading contents, explain the concepts and provide additional context for specific concepts. The fun light-hearted analogies are also a welcome break to some very dry content.I usually watch the videos before going into more in-depth reading and they are a good way to avoid being overwhelmed by the sheer volume of content when you look at the readings.

Kriti Dhawan

2021-07-16

A great curriculum provider. James sir explains the concept so well that rather than memorising it, you tend to intuitively understand and absorb them. Thank you ! Grateful I saw this at the right time for my CFA prep.

nikhil kumar

2021-06-28

Very well explained and gives a great insight about topics in a very short time. Glad to have found Professor Forjan's lectures.

Marwan

2021-06-22

Great support throughout the course by the team, did not feel neglected

Benjamin anonymous

2021-05-10

I loved using AnalystPrep for FRM. QBank is huge, videos are great. Would recommend to a friend

Daniel Glyn

2021-03-24

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

2021-03-18

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Trustpilot rating score: 4.5 of 5, based on 69 reviews.

Related Posts